TEAM

We are a partnership of principals with over 50 years of experience sourcing, capitalizing, and executing value-add business plans to reposition and improve residential communities.

Sean J. Belfi, CFA

Co-Founder, Managing Principal

As Managing Principal, Mr. Belfi leads day-to-day operations at CSC structuring and overseeing equity and debt partnerships.

Craig S. Boyarsky

Co-Founder, Principal

As a Principal, Mr. Boyarsky focuses on acquisitions, asset management, and business development initiatives for the firm.

Brendan P. Glavin

Co-Founder, Principal

As a Principal, Mr. Glavin focuses on acquisitions, asset management, and business development initiatives for the firm.

Eric S. Horowitz

Co-Founder, Principal

As a Principal, Mr. Horowitz focuses on the firm’s equity and debt partnerships.

STRATEGY

Source

We seek to invest in supply-constrained markets with high barriers to entry and strong household demographics

- Acquire existing assets at a deep discount to replacement cost with value-add potential

- Invest in markets with restrictive zoning laws and high construction costs

- Target regions with stable employment and median household incomes in line with or above the national average

Business Plan

We implement a balanced investment strategy focused on targeted capital deployment and intensive operations to expand Net Operating Income and create value

- Revenue optimization and expense efficiency

- Strategic “offensive” and “defensive” capital investments

- Accretive interior unit renovations and exterior modernization

Reposition

We are proactive, hands-on asset managers who oversee the full investment lifecycle

- Utilize best-in-class, regional, third-party property management

- Lever efficiently via CSC's deep capital markets and GSE relationships

- Execute capital events strategically upon business plan completion

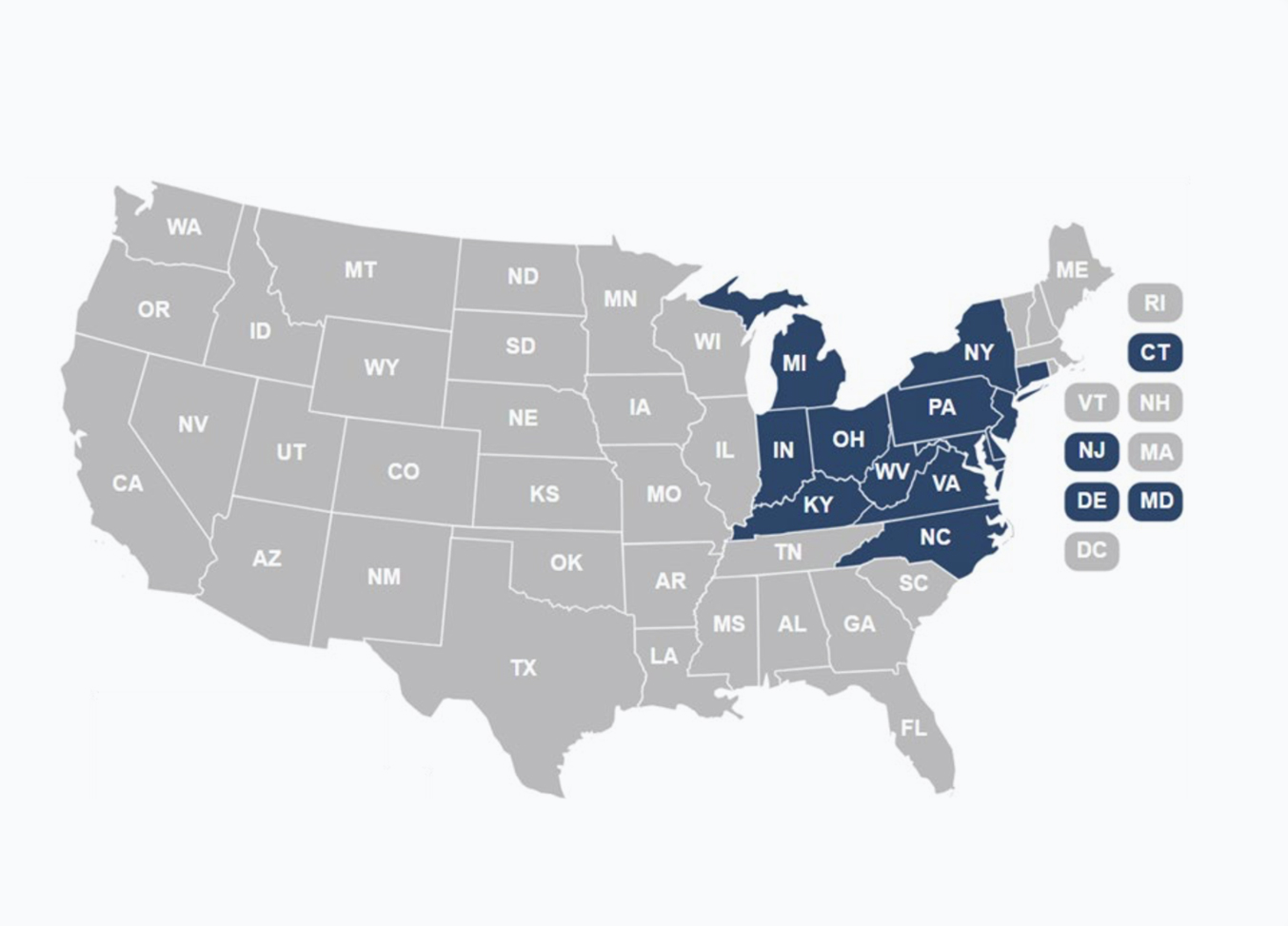

MARKETS

"We target high barrier-to-entry markets that feature strong demographics, diversified job drivers, attractive seller profiles, and a discount of existing product to Class A."

Market Fundamentals

Our data-driven approach focuses on supply and demand dynamics to identify markets with long-term stability and growth potential.

| Rent-to-Income <30% |

| Household Income 60%-120% of AMI |

| Discount to Replacement Cost and Class A Rents |

| Restrictive Zoning Laws |

| Diversified Employment |

| New Supply <5% of existing inventory |